ct sports betting tax

Aside from the 20 tax the state would collect from online casino games it would collect a 1375 tax on sports bets placed with the casinos online or in person rates that the administration. A 1375 tax rate on online and land-based sports betting.

Ct Collects Nearly 2 Million In First Month Of Online Gaming And Sports Betting Nbc Connecticut

This rate applies equally to both the tribes and the lottery though the latter is apparently seeking to.

. Ad Mohegan Sun FanDuel Sportsbook is your home for sports betting. A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by. A 1375 tax rate on sports wagering and an 18 tax rate for the first five years on new online commercial casino gaming would go into effect followed by.

That is higher than the rate charged in states such as Nevada and Iowa but it. The most important of these conditions is that you cant claim losses that total more than your gains. Among its key provisions are an 18 percent tax rate for the first five years on new online commercial casino gaming followed by a 20 percent rate for at least the next five years.

May a resident or part-year resident claim a credit against his or her Connecticut income tax for income tax paid to another state on gambling winnings. 15 land-based sports betting bricks-and-mortar locations with each land-based facility offered at least 1 online sportsbook license. Sports betting losses are tax-deductible but under very specific conditions.

Tax payments from sports betting operators in February were the lowest yet. When will CT online sportsbooks launch. There are only three sportsbook brands in Connecticut at.

The Mashantucket Pequot Tribal Nation the Mohegan Tribe and the Connecticut Lottery. The Indiana sports betting tax rate is 323 which is pretty reasonable when compared to the betting tax charged by some other states. Sports betting tax rate The tax rate sits at 18 for bets placed online and 1375 for bets placed in-person.

Many are still hopeful that Connecticuts first sports betting options will launch prior to the start of the 20212022 NFL season. Connecticut will impose a fixed tax rate of 1375 of gross sports betting revenue putting it in the middle of the range among US states with legal wagering. The revised gambling rules signed into law calls for an 18 tax for the first five years on online commercial casino gambling followed by a.

Connecticut lawmakers set the sports betting tax rate at 1375 percent regardless of whether the gross gaming revenue GGR is derived online or at a land-based location. Neither a resident nor part-year resident is eligible to claim a credit against his or her Connecticut income tax for. The tax rate for sports betting will be 1375 on revenue.

Since that time officials have been working hard to finally launch sports betting platforms here. Sublicense locations for the state-licensed parimutuel operator and new land-based sports betting venues in both of Bridgeport and Hartford. February figures were posted online March 15 and during that month the state received 501516.

The state will collect taxes of 18 initially on online casino gambling increasing to 20 after five years. Connecticuts lawmakers formally approved a sports betting bill back in May of 2021. So if you lost 5000 on sports betting last year but took home 7000 in the end youd be able to deduct all of those losses.

Which sportsbook apps are coming to Connecticut. If you are married and file jointly or you are a qualifying widow er this is your tax schedule for 2021. Connecticut income tax applies to all gambling winnings included in federal adjusted gross income.

Online sportsbooks launched in the state to the general public on Oct. Connecticut sports betting apps pay a 1375 revenue tax. Proceeds will go to a college fund to allow students to attend Community College for free and also to fund some smaller municipalities in the state.

600 plus 5 of the excess over 20000. Experience the best sportsbook in Connecticut. There would be a 1375 percent tax rate on sports wagering.

4600 plus 55 of the excess over 100000. And 1375 on sports betting and fantasy sports. The state taxes sports betting revenue each month from three master licensees.

DraftKings FanDuel and PlaySugarHouse all launched on the same day. Sports gambling just got better.

Mass Senate Passes Sports Betting Bill Wbur News

Casino Executives Argue Sports Betting Elsewhere Is Pulling Workers Out Of Massachusetts

Which States Will Launch Sports Betting In 2022 Yogonet International

How Much Tax Revenue Is Every State Missing Without Online Sports Betting

Legal Sports Betting Brought In 4m For Connecticut During Its First Full Month

The Best Guide For Sports Betting Taxes What Form Do I Need Ageras

Before Sports Betting Opens Connecticut Addresses Problem Gambling

Sergey Tsukanov About Betting Market Challenges In 2020 And Hopes For 2021

Gambling Pays Out A 38 Billion Bonus To Tax Collectors

Five Things To Know About Legalized Sports Betting In Connecticut The Connecticut Examiner

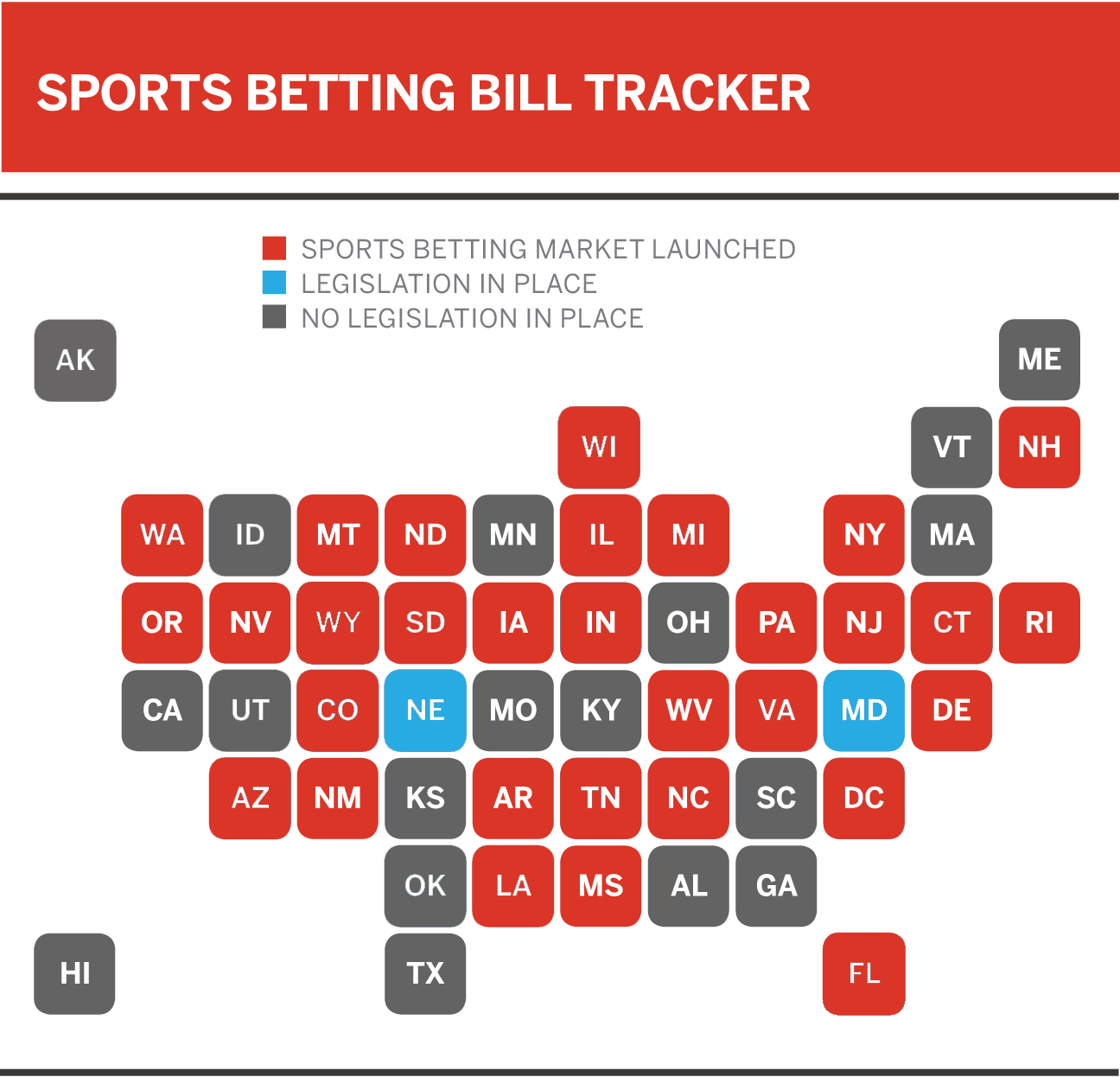

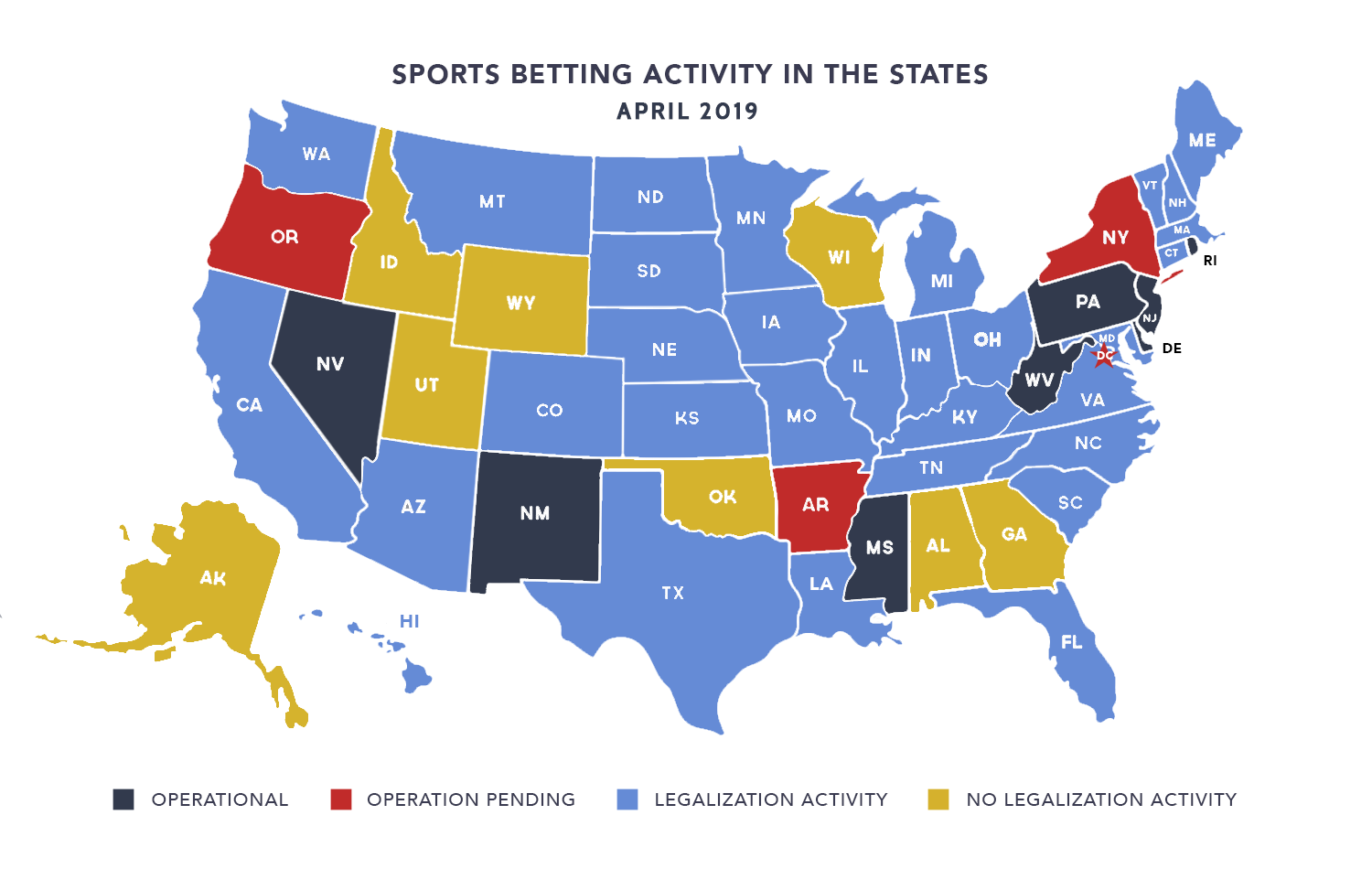

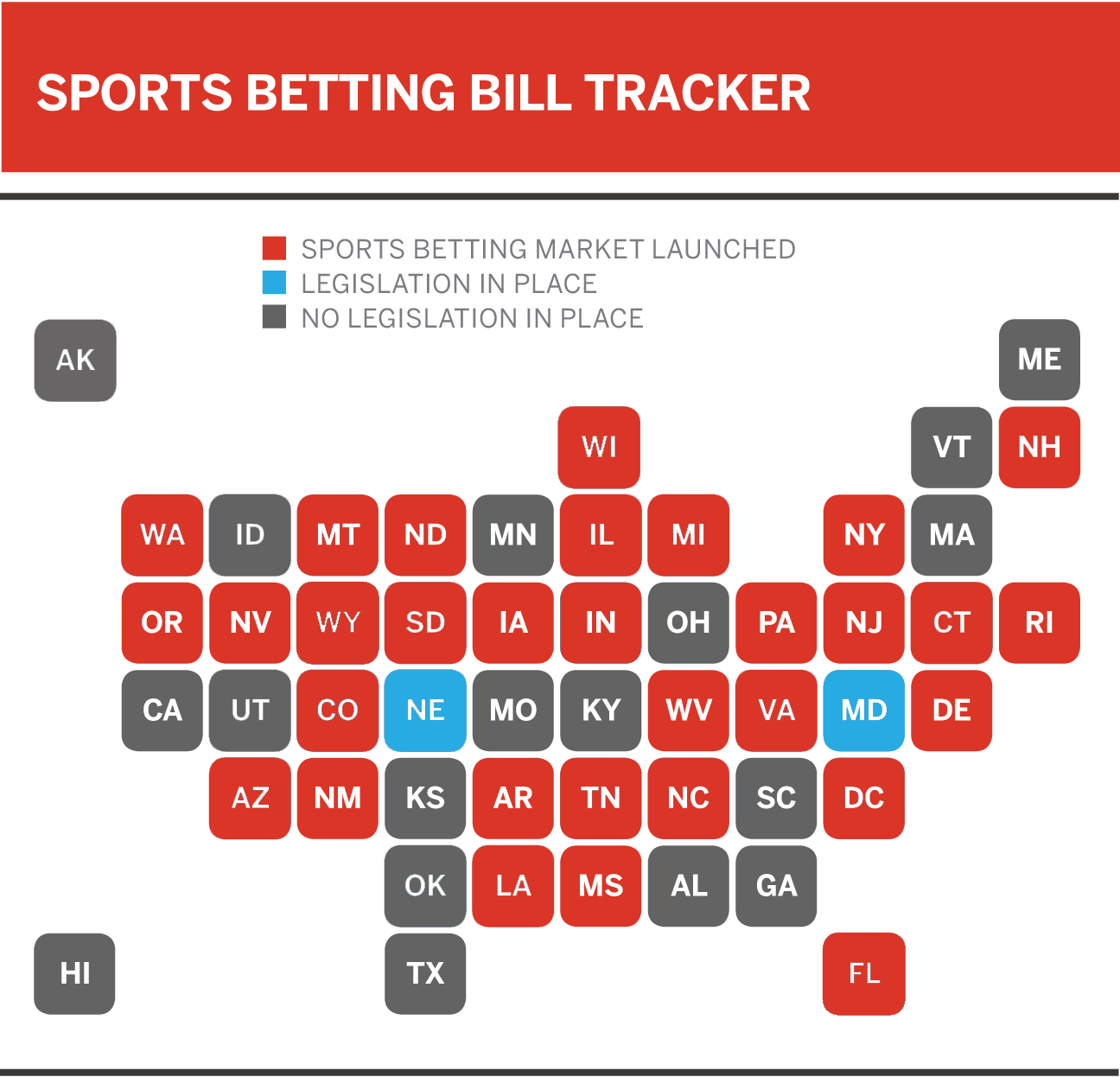

Interactive U S Map Sports Betting American Gaming Association

New York Tops Nation In Sports Betting Tax Revenue As Promotions Taper Crain S New York Business

Sports Online Gambling To Start In October Ct News Junkie

Assessing State Sports Betting Structures Aaf

Sports Betting To Win By Steve Ward Ebook Scribd

The United States Of Sports Betting Where All 50 States Stand On Legalization

U S Sports Betting Market Will Be Worth Up To Us 13 Billion By 2025 Gaming And Media

U S Sports Betting Market Will Be Worth Up To Us 13 Billion By 2025 Gaming And Media

New York Sports Betting Licenses Going To Fanduel Caesars 7 Others Sportico Com